GCC Building Construction & Interiors Market

This study on the GCC building and interiors industry focuses on the developments in the following sectors of the building construction industry:

Commercial real estate sector

Hotels sector

Residential sector

Retail sector(comprising shopping malls)

Hospital sector and

Education facilities sector

The GCC interiors design and fit-out industry is propelled by huge building projects across the region.

In 2017, US$ 74,836 million worth of GCC building projects are expected to be completed across segments including residential, commercial, hotels, retail sectors, medical, education facilities projects, which is and increase from US$ 69,176 million in 2016 (refer Figure 1).

A surge in construction activities influences growth in the GCC interiors and fit-out market, which constitutes approximately 10 to 22 percent of the average construction project value.

With the falling Oil prices, many developers in the GCC region are looking forward to providing a facelift to their existing project structures to meet new demands of the people.

Currently, developers and owners are investing heavily into strengthening their business development despite budgets belts tightening in the region due to fluctuations in oil prices. There is a renewed emphasis on refurbishment as owners look to re-invent existing structures to serve new needs and demands, while the introduction of green building ratings and codes have forced a change in mind-sets across the industry. Fit-out contractors are now asserting their dominance and vitality in a market increasingly in need of their services.

Tendering for the right project within the market’s current climate remains a crucial element for a company’s long-term sustainability for projects. Planning, phasing and programming are all essential aspects while undertaking large-scale refurbishment projects. Flexibility, at the fit-out contractor’s end, is also fundamentally important; to be able to accommodate any last minute changes to the design or the project timeline, which almost always happens with all large projects.

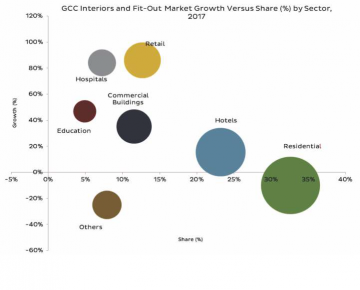

The GCC interior and fit-out spend by the building sector is estimated to be worth US$ 9,230 million in 2017, an increase from US$ 8,262 million in 2016. The residential and hotels sectors are likely to attract the most investment in 2017 and 2018 attributed largely to strong population growth and tourist arrivals duging mega events ( refer er Figure 2). These figures are indicative of the growing importance of interiors and fit-out contracting as a market segment in the construction industry. New buildings add only one percent to building volume each year and the remaining 99 percent of buildings require regular renovation and refurbishment to stay in good shape and meet modern standards.

The UAE is clearly spearheading the interiors and fit-out spend in the GCC region followed by the Saudi Arabia (KSA) and Qatar(refer Figure 3). The UAE’s interior and fit-out contracting market is expected to register 15 to 20 percent growth by 2017 – end as the country gears up to hosting the Dubai Expo 2020. The event will award 47 construction contracts worth US$ 3billion in 2017 as preparations continue to gather pace. While 2016 was an important year for design, 2017 is when the momentum of construction will really build, ahead of international participants beginning work on their pavilions in 2018. The UAE is currently promoting energy efficient renovations on existing buildings. Also, heritage conservationists are calling for an in – depth study of buildings that evoke memories of the UAE’s development. A law to preserve century old building has been passed by the FNC and is awaiting the government’s approval.

KSA has the largest construction market in the GCC and scores highly for the amount of investment made in the economy. Industry experts have estimated that spending on interior finishing items in KSA will grow by 13.7 percent by 2017, which is attributed to the National Transformation Plan (NTP) 2020 and Saudi Vision 2023. In addition, KSA and the UAE have undertaken major renovation and refurbishment programmes, repectively, to upgrade old public buildings using sustainable products and smart technology.

Although Qatar announced a deficit in its budget, the country is currently spending of US$ 500 million a week on capital projects in preparation for its World Cup 2022. This level of spending is expected to continue up to 2021 with mega-projects under construction across the country, which is likely to provide more opportunities for interior and fit-out investors and developers. Qatar issued 574 new construction permits in December 2016 for residential and commercial projects. New buildings for housing and business purposes topped the list, receiving 356 permits from the country’s municipalities. There were 163 permits for small house and villa construction while the rest covered small houses and building expansions.

In 2017, the residential sector is likely to continue to maintain its position as the largest market for interiors and fit-outs in the GCC followed by the hotels sector(refer Figure 4). The residential sector is certainly a trending sector is certainly a trending sector in the GCC as the governments make housing a priority in their agenda to cater to the needs and demands of the young and growing local population. Owners of existing structures, whether residential or hotels are under pressure to optimize the value of their projects by refurbishing them. Some of the buildings in the GCC region are quite old and renovation and refurbishment is needed in order to maintain their market value. Majority of hotels in the GCC have crossed the seven – year operational threshold and many are in need of renovation and refurbishment. As the hotels market is very competitive, it is likely to push the current hoteliers to re-invent their offeing and hence interiors and fit-outs form an important part in their agendas. Report courtesy ventures onsite.